In the corporate world of finance, ESG is “in”. Indeed, ESG is an acronym of three words in English, meaning environmental, social, and governance.

The environmental criteria include a company’s use of energy, waste, pollution, conservation of natural resources, treatment of animals, and assessing the environmental risks a company may face and how such risks are managed. The social responsibility criterion, on the other hand, considers the company’s commercial relations, whether the suppliers have the same values, whether a percentage of their profits is donated to the local community or if their employees are encouraged to perform volunteer work, whether the company’s working conditions value the health and safety of their employees and if the interests of other stakeholders are taken into account. Finally, the governance criterion considers whether accurate and transparent accounting methods are used by the company, whether shareholders have the opportunity to vote on important issues, whether there are guarantees that companies avoid conflicts of interest when choosing board members, if using political contributions to obtain unduly favorable treatment is prohibited and whether the company does not engage in illegal practices.

Historically, from the Vietnam War and the human tragedy shown to the world, a protest movement began in the American university environment against investments in the armaments and war materials industry. However, it was in the ‘90s that the term sustainability began to gain relevance in the corporate environment and the first global index to measure sustainability criteria was created: Dow Jones Sustainability Indices. Indeed, in 1992, ECO 92 was held in Rio de Janeiro, which was the first United Nations Conference on Environment and Development. Another interesting milestone was the design of the Triple Bottom Line created by Elkington:

In the wake of this movement, an international group of institutional investors, under the umbrella of the United Nations Environment Programme Finance Initiative (UNEP FI) and the United Nations Global Compact, created the Six Principles for Responsible Investment (PRI):

1. We will incorporate ESG issues into investment analysis and decision-making processes.

2. We will be active owners and incorporate ESG issues into our ownership policies and practices.

3. We will seek appropriate disclosure on ESG issues by the entities in which we invest.

4. We will promote acceptance and implementation of the Principles within the investment industry.

5. We will work together to enhance our effectiveness in implementing the Principles.

6. We will each report on our activities and progress towards implementing the Principles.

Ever since the creation of the PRI, the impulse given to sustainability and to environmental, social and governance issues when attracting investments was impressive. The table below provides an exact dimension of the global dissemination of the concept:

Let’s move on to a brief analysis of how to incorporate these 6 (six) principles into the daily business routine.

1.7. INTEGRATING ESG FACTORS IN INVESTMENT ANALYSIS AND DECISION-MAKING

8. Address ESG issues in investment policies;

9. Support the development of tools, metrics, and analysis regarding ESG factors;

10. Assess the ability of internal investment managers to incorporate ESG factors;

11. Assess the ability of external investment managers to incorporate ESG factors;

12. Request investment service providers (such as financial analysts, consultants, brokers, research agencies, rating agencies) to integrate ESG factors such as analysis and research evolution;

13. Encourage academic and other research on this topic; and

14. Promote ESG training for investment professionals;

1.8. BE PROACTIVE AND INCORPORATE ESG FACTORS INTO POLICIES AND PRACTICES

9. Develop and disseminate an active asset ownership policy in line with the Principles;

10. Exercise the right to vote or monitor compliance with voting policies (if outsourced);

11. Develop engagement capability (directly or through outsourcing);

12. Participate in the development of policies and regulations and setting standards (such as promoting and protecting shareholder rights);

13. File shareholder resolutions following the long-term guidelines in ESG;

14. Promote engagement with companies regarding ESG issues;

15. Participate in collaborative engagement initiatives; and

16. Request dedication of investment managers in engaging and reporting ESG factors.

1.9. DISCLOSURE OF ACTIONS REGARDING ESG FACTORS

5. Request standardized reports on ESG factors (using tools such as the Global Reporting Initiative);

6. Request the integration of ESG factors into annual financial reports;

7. Request information from companies on the adoption/adherence to norms, standards, codes of conduct, or international initiatives regarding the subject (such as the UN Global Compact); and

8. Support the initiatives and resolutions of shareholders that promote the disclosure of ESG factors.

1.10. PROMOTING ACCEPTANCE AND IMPLEMENTATION OF THE PRINCIPLES

7. Include requirements regarding the Principles in Requests For Proposals (RFPs);

8. Align investment mandates, monitoring procedures, performance indicators and incentive structures according to the Principles (e.g., ensure that investment management processes reflect long-term time horizons as appropriate);

9. Communicate ESG expectations to investment service providers;

10. Review relationships with service providers that do not meet ESG expectations;

11. Support the development of tools for the integration of an ESG baseline; and

12. Support policy or regulatory actions which enable the implementation of the Principles.

1.11. ENHANCING EFFECTIVENESS IN IMPLEMENTING THE PRINCIPLES

4. Support/participate in information networks and platforms to share joint tools and resources, in addition to using investor reports as a source for learning;

5. Collectively address relevant emerging issues; and

6. Develop or support appropriate collaborative initiatives.

1.12. DISCLOSURE OF REPORTS ON ACTIVITIES AND PROGRESS IN IMPLEMENTING THE PRINCIPLES

8. Disclose how ESG factors are integrated into investment practices;

9. Disclose the active involvement in detention and asset ownership issues (voting, engagement and/or policy dialogue);

10. Disclose what is required from service providers regarding the Principles;

11. Provide beneficiaries with information on ESG factors and the Principles;

12. Report on progress and/or achievements regarding the Principles using a “Comply or Explain” approach;

13. Determine the impact of the Principles; and

14. Use reports to raise awareness among a wider group of stakeholders.

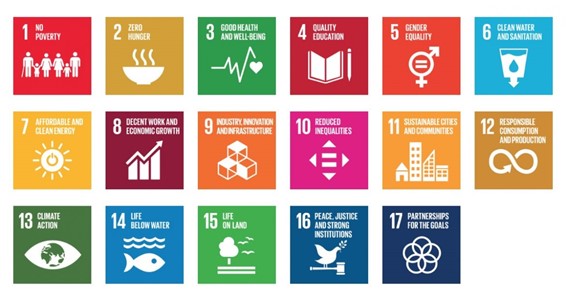

In a parallel effort to eradicate poverty, protect the environment and the climate, and ensure that people everywhere can enjoy peace and prosperity, the UN has instituted 17 (seventeen) sustainable development goals, so that its Member States pursuit its implementation by 2030. These goals are listed below:

These sustainable development goals should be considered in an organization’s implemented ESG strategy.

The SASB standards, which identify the most relevant ESG issues for 77 different sectors, are another important tool that should be considered when outlining the organization’s ESG strategy.

Currently, there are ESG criteria research firms, such as Just Capital, S&P Dow Jones Indices, Refinitiv, Bloomberg, etc., which collect data and create a ranking in the financial sector for a vast number of companies, assigning a score that goes up to 100 points. Naturally, higher scores imply better company performance in the ESG criteria. To assign this score, documents such as annual reports, corporate sustainability measures, resources/employees/financial management, board structure and compensation and so on are analyzed under the ESG premise.

As ESG criteria can henceforth dramatically change investment allocation, companies seeking investments or managing investment portfolios should not mistakenly underestimate this bias for business. Situations such as oil spills, emissions of CO2 and gases attacking the ozone layer such as CFC, and critical failures in company governance are examples of increasing challenges that companies will face when attracting investments.