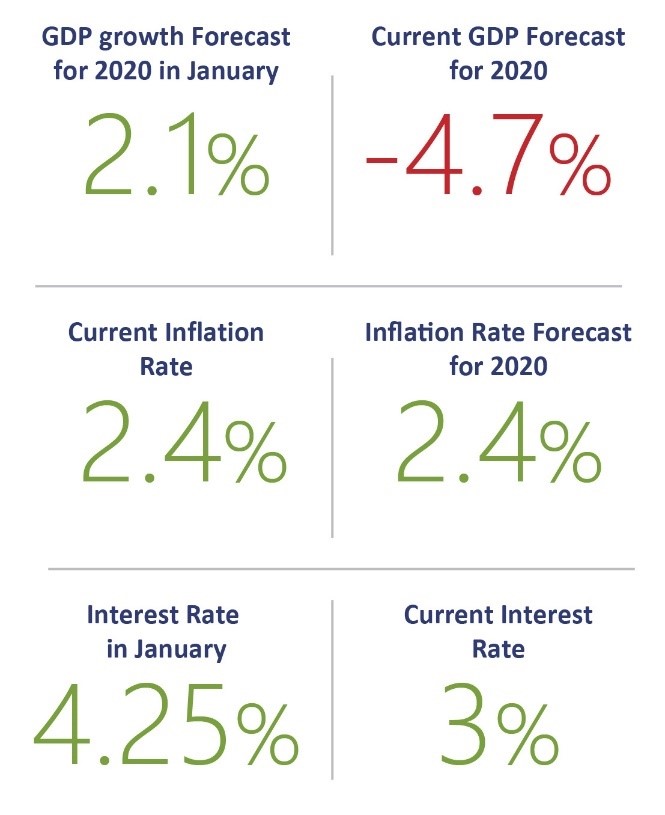

On March 20th, the Brazilian Senate approved the Legislative Decree that recognized a state of public calamity and a situation of public health emergency in Brazil due to the Covid-19 global pandemic, which will be in force until December 31st, 2020. The voting took place during the first remote deliberative session held by the National Congress in its history. Due to the economic and social crisis caused by the disease, the Brazilian Government revised its GDP growth projection,which has already decreased by almost 7%. The official forecast fell from 2.1%to -4.7%, with the consequent impact of reduced public revenues.

Although the country’s stock exchange market has closed the first quarter of the year with a loss of 36.86%, the past months presented a meaningful improvement. In April, the gains were about 10%, and May seems to maintain that tendency. The currency rate reached over six reais per dollar, and the inflation forecast for the year is 2.4%.The Brazilian Central Bank (BACEN) recognized the slowdown in the global economy and decided to reduce the basic interest rate (Selic) from 4.25% to 3%,reaching a new historic low.

In this article, we present the ongoing policy measures taken by the Executive and Legislative branches to constrain the Covid-19 outbreak and restrain its impacts on the Brazilian economy and society. The final sections present the actions directed to the private companies, the National Health System (SUS), and the most vulnerable social groups.

Executive Branch

On March 17th, the Executive Branch created a Crisis Committee comprising all Brazilian minister sand representatives from Banco do Brasil, the Brazilian Development Bank(BNDES), and Caixa Econômica Federal. The Committee has daily meetings to monitor the impacts of Covid-19 in Brazil and to discuss joint actions from the Federal Government that could mitigate the disease’s impact on society. The Committee’s work is under the coordination of the Chief of Staff Office.

The Brazilian Fiscal Responsibility Act (LRF) establishes the state of public calamity as a temporary condition that suspends the deadlines for adjusting expenses and indebtedness limits, and for the adoption of expenditure contingency. Under this status, the Federal Government is exempt from being charged if it does no treach the fiscal target determined by the LRF. However, it does not eliminate the need for the Administration to comply with the spending ceiling and the Golden Rule¹.

The Ministry of Economyis working to reduce economic recession impacts. The recognition of the state of public calamity in Brazil eases the use of public revenues for the emergency actions needed to contain the Covid-19 outbreak. The measure compromises the Government’s fiscal target reach and increases the shortfall in the country’s public account, which already sums provisions of around USD 116 billion for the year.

President Jair Bolsonaro determined the extension of temporary closure of Brazil’s land borders with its 9 neighbor countries. Outside Latin America, the President has also chosen to restrict the entry into the country by air and water for 30 days for any foreigner, except those who (i) have a permanent visa, (ii) are born and naturalized Brazilians, are (iii) spouses of Brazilians, (iv) are professionals in service of an international organization or (v) foreign officials accredited to the Brazilian government. The measures expire on 28th and 29th May respectively and do not affect the transport of cargo and goods, which remains authorized.

Regarding restrictions on commercial and industrial establishments, the measures are being taken by Governors and Mayors in order to curb the Covid-19 outbreak. As of March 20th, all the 26 Brazilian states plus the Federal District had already announced restrictive measures, exempting only food, pharmaceutical, and hospital establishments. In the two major states where the Covid-19 has had its largest spread, Rio de Janeiro and São Paulo, social distancing and commercial restriction measures were extended until May 31st and June 15th, respectively.

Legislative Branch

On March 17th,the House of Representatives and the Senate agreed on procedures to use the Remote Deliberation System (SDR), which allows Congressmen to discuss and vote on matters from a distance. Board members and party leaders are in Brasília to coordinate the work, ensuring the rapid discussion and voting of important issues.

The sessions held through the SDR are virtual and must be called at least 24 hours in advance -unless they are held in sequence – for deliberation on legislative matters of urgent nature, that is, those that cannot wait for the situation to normalize. Each session has a single agenda item and a maximum duration of up to six hours, extendable by the Speaker for the necessary time, depending on its urgency.

Three major bills related to the Tax Reform are currently under examination by the Congress,which intended to unify the texts. The Minister of Economy, Paulo Guedes, was supposed to participate in a public hearing on March 18th, to discuss the subject. Nevertheless, the hearing was canceled due to the Covid-19 pandemic. Now, despite the subject of tax reform is no longer qualified as an urgent issue as it was before the Covid-19 spread, the Speaker of the House of Representatives, Rodrigo Maia, expects that its deliberation may return in early June.

Also, a Mixed Committee,formed by six Representatives and six Senators, is monitoring the Executive Branch’s actions related to the state of public calamity. The Committee is having monthly meetings with members from the Ministry of Economy to assess how public resources are being allocated to emergency measures.

Regarding the States’ Legislatures, several States’ General Assemblies canceled their activities during the pandemic. Some of them, such as the Assemblies of Rio de Janeiro, Ceará, and Minas Gerais, are studying the possibility of using a remote system to maintain their voting schedules.

Private companies, the National Health System (SUS), and the most vulnerable social groups

The Federal Government announced a series of measures to deal with the Covid-19 crisis’ impacts on private companies, the National Health System (SUS) and the most vulnerable social groups. The Brazilian Administration created special lines of credit, granted tax exemption and financial aids to the most affected companies, such as the airlines. Emergency actions, such as increasing resources to strengthen the States’ public health system, were taken to contain the spread and the effects of the virus. According to Guedes, the economic measures announced to tackle the Covid-19 spread sum around USD 170 billion. The following sections present the main measures taken by the Government in the three fronts.

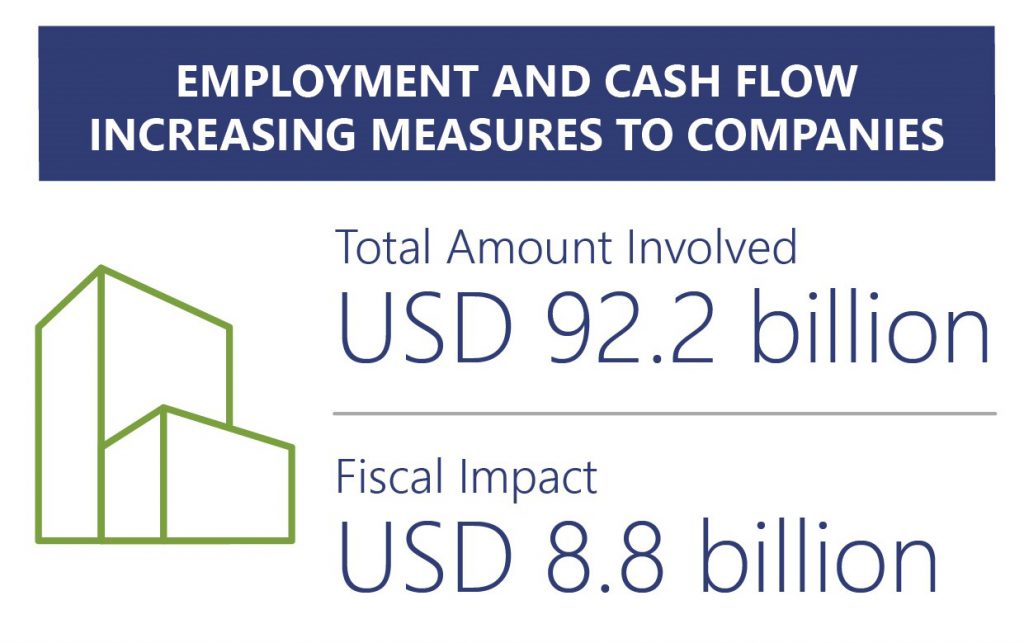

Support measures targeting Companies

The Federal Government is taking measures aimed at temporarily relieving companies from paying off their debts and taxes. Also, special actions are targeting banks and their credit-granting capacity. The intention is to simplify the companies’ credit acquisition – especially the small and medium-sized enterprises (SMEs), which are suffering the most from the economic impacts of the pandemic.

For the companies, the Ministry of Economy has delayed tax payment deadlines, proposed facilitated credit for SMEs, and reduced obligatory contributions for business associations, to prevent bankruptcy and lay-offs. The Finance Operations Tax (IOF), applied to transactions made abroad or to foreign banks, has been suspended until July. Also, the Workers’ Support Fund Deliberative Committee (CODEFAT) released more than USD 1 billion to be transferred to public banks so they may grant loans to SMEs.

BNDES approved aid measures of around USD 11 billion, such as (i) the temporary suspension of payments regarding installments of direct and indirect financing to companies and (ii) the expansion of credit to SMEs through BNDES’s partner banks, in the amount of USD 1 billion. BNDES has also included fintechs and credit startups inits operationalization credit line. Now, SMEs have more alternatives to choose on who finances their working capital.

BACEN exempted banks from increasing their mandatory provisional savings, allowing them to renegotiate credit operations targeted at companies and families. Also, the bank decreased the minimum savings that banks must have to carry out credit operations. More recently, BACEN has also authorized a swap line with the New York FED in the amount of USD 60 billion to operations carried out until the end of September. The measure increases BACEN’s ability to provide liquidity in dollars.

Aligned with the measures mentioned above, the National Treasury Attorney’s Office (PGFN) also took its step regarding the relief of the indebted and suspended the debt collection acts. It also took measures to facilitate debt renegotiation due to the COVID-19 pandemic. At last, Caixa Econômica, a major Brazilian government-owned bank, created several credit lines for different economic sectors, such as the agriculture,which received around USD 1 billion on credit resources. The bank also allocated around USD 21 billion to very-low interest credit portfolios in order to stimulate SMEs. It also amplified real estate financing after allocating around USD 7.5 billion on resources that, according to Caixa Econômica, will benefit more than 5 million families and preserve more than 1.2 million jobs.

Moreover, through Provisional Measure #944,of 2020, the Government announced a reduced interest rate loan of around USD 8 billion for SMEs. It aims to pay these companies’ payroll and to assure jobs are kept as they are. During the pandemic period, companies who take out the loans must not fire their employees. The measure covers all employees who earn up to two minimum wages (USD 420), and the companies have six months to start paying off their loans. The Government expects the action will benefit more than 12 million workers and 1.4 million SMEs (with annual revenues of USD 72 thousand to USD 2 million per year).

Provisional Measure #936, of 2020

On April 1st,the Federal Government published Provisional Measure #936, of 2020, which established an emergency program aimed at preserving jobs and salaries. For the next three months, working relations will be modified by the Federal Government, which will offer to companies and their employees a financial aid to reduce the impact of economic losses due to the COVID-19 spread.

The measure allows companies to reduce wages and workdays duration, or even to suspend working contracts in order to preserve their financial health in the long term. Unlike Provisional Measure #927, the action provides space for individual agreements between employers and employees to ensure that the Government must complement the value discounted from the worker’s wage. Wages and workdays may be decreased by 25%,50%, or 75%. On the other hand, the Government will provide a reparation calculated according to the unemployment insurance whose value will compensate what was discounted from the worker’s wage. Thus, a relief of 75% percent on the payroll of an employee will be partially complemented by a 75% payment from the unemployment insurance.

In the cases where the discount was by 50% or 75% percent, the individual agreements will only be signed since the worker earns less than USD 627 or more than USD 2,440. Those who receive between these values will have to reach a collective agreement. In order to fit in the Provisional Measure, the Government requires that the suspension of the working contracts may last only up to 90 days. The benefited companies’revenue must not revenue overcome USD 9,000.

Provisional Measure #927, of 2020

On March 22nd, the Executive Branch published Provisional Measure #927, of 2020. The text temporarily eases excerpts from the Brazilian Labor Law (CLT) to reduce employers’ costs and maintain formal jobs. The Provisional Measure will remain valid as long as the country is under a state of public calamity. Among other actions, the measure allows the postponement of the monthly payment of the employees’ Guarantee Fund for the Length of Service (FGTS) for three months. The norm also provides a flexibilization of the requirements for establishing a remote working (home office) regime, for anticipating individual vacations and determining collective vacations. The Government expects the measure will ensure temporary savings on the companies’ budgets.

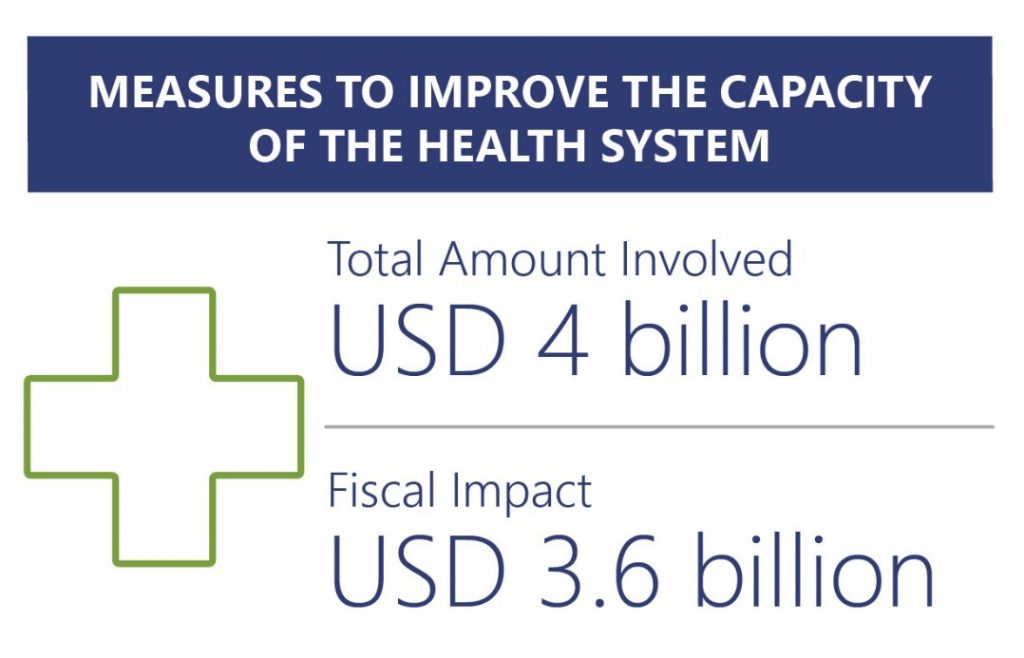

Support actions to improve the capacityof the National Health System (SUS)

The Brazilian Administration has been allocating extra funds to prepare the public health system to face the demand increase due to the spread of COVID-19. The major actions seek to guarantee the supply of medical items and expand the hospitals’capacities. The Ministry of Economy has cut tariffs and simplified import customs procedures for medical supplies. Import taxes on medical items such as alcohol 70%, hand sanitizer, masks, protective clothing, and breathing apparatus were suspended. A special license is now required for these items to be exported, in order to make sure the national market does not run out of these products.

On March 16th,when the disease reached a high contamination rate, an amount of around USD 1 billion from the Insurance for Traffic Accidents fund balance (DPVAT) was transferred to the Ministry of Health. Also, President Bolsonaro sent Congress the Provisional Measure #924, of 2020, for establishing a USD 1 billion credit to strive against the coronavirus. The amount was transferred to the Brazilian Hospital Services Company, to the National Health Fund, and the Oswaldo Cruz Foundation (FIOCRUZ).

The Brazilian Institute of Geography and Statistics (IBGE) announced, on March 17th, the postponement of its socioeconomic population census. The budget of USD 383 million previously planned to finance the study was then allocated to the Ministry of Health in order to strengthen the Health public system and contain the propagation of Covid-19. According to the research institute, the same amount will be transferred from the Health Ministry into the IBGE on the next year to guarantee the accomplishment of data mapping of the Brazilian population.

Also, the Ministry of Health announced, through a note on its platform on April 20th, a measure to increase diagnostic tests for COVID-19. Both by direct purchase and by donation, the body intends to expand the initial estimate of 23.9 t o 46.2 million available exams. The efforts had in my mind the forecast of abrupt rise of deaths and infections along the month of May and June. The FederalGovernment still has not announced how and when it plans to purchase that amount.Nevertheless, informers from the Government point that over the next week an agreement measured on USD 167 million might be reached².Without a public bidding, several companies can fulfill the Government’s demand. The best offer so far comes from Sallus, a Brazilian company which commits to deliver the large 12 million tests, in the short term.

Other important Provisional Measures allocated to the Healthcare sector

On April 2nd,the Government published Provisional Measures #940 and #941, of 2020. The former releases USD 1.89 billion to supply the Public Health System. The amount will be shared between the Oswaldo Cruz Foundation (FIOCRUZ), which will receive about USD 91.2 million, and the National Health Fund (FNS), where the remaining USD 1.8 billion should go.

In turn, Provisional Measure #941, of 2020, releases more than USD 422 million to be shared among the Ministries of (i) Health, (ii) Education and (iii) Citizenship to develop actions aimed at strengthening SUS. The largest amount of the transfer was allocated to the Ministry of Health, which will receive USD 400 million to be invested on 23 states, including São Paulo, Rio de Janeiro, and Minas Gerais.

Published on April 8th,Provisional Measure #947, of 2020, forwards USD 430 million to the Ministry of Health’s budget. According to the Government, the amount is aimed at the acquisition of Personal Protective Equipment (PPE) such as aprons, masks, pulmonary ventilators, alcohol, and gloves. These items will be distributed to states, municipalities,and the Federal District to be used by public health professionals.

Provisional Measure#962, of 2020, published on May 7th, forwards to the Ministries of Science, Technology, Innovations and Communications (MCTIC) and Foreign Affairs(MRE) the total amount of USD 70 million due the spreading of Covid-19. Once the value was divided, the MCTIC received USD 21 million to finance expenses on applied technologies, innovation, and sustainable development. MRE received USD 49 million and will use it to afford exceptional costs of foreign policy and support for vulnerable Brazilians living abroad.

On May 20th,the Executive Branch published the Provisional Measures #967 and #969, of 2020. The former has released USD 916 million to the Ministry of Health. Similar to Provisional Measure #940, the new credit will be again shared between the Oswaldo Cruz Foundation (FIOCRUZ), which will gain USD 116 million, and the National Health Fund (FNS), where the large amount of around USD 800 million will be applied. In turn, Provisional Measure #969, of 2020, releases resources of around USD 1.6 billion exclusively to FNS.

Support measures to tackle the impactson the most vulnerable groups

Due to unfavorable economic prospects, the Ministry of Economy is taking measures focused on the social groups that are most vulnerable to the impacts of Covid-19, such as the elderly, the unemployed, the self-employed, and the informal workers. Through an estimated spending of USD 37.5 billion, the Government intends to reconcile the protection of the population’s health with social welfare and the maintenance of social security benefits while the country remains under a state of public calamity. It will also improve income distribution programs as well as measures for facilitated loans.

Firstly, the Federal Administration decided to anticipate the 13th salary for pensioners.The amounts that would be paid in December and January 2021 have been paid in April and May. The measure aims to guarantee that the pensioners can afford eventual health treatment costs related to Covid-19. The National Institute of Social Security (INSS), responsible for the pension and social security benefits payments, has also negotiated actions with other financial institutions to facilitate virtual transactions so that the benefits can be withdrawn from ATMs.

On March 25th,through Provisional Measure #929, of 2020, the Government also announced the release of USD 700 million to the Ministries of (i) Science and Technology,(ii) Foreign Affairs and (iii) Citizenship. From the total amount, USD 614 million were destined to the Bolsa Família Program³.

On March 27th,the President of Caixa Econômica announced a decrease on its interest rates and a postponement of three months for mortgage loans payments. The measure benefited over 800 thousand families. President Bolsonaro also sanctioned Law#13,982, of 2020, that grants, for April, May and June, a USD 120 individual monthly voucher for informal sector and intermittent workers, as well as unemployed members of low-income families. The action is expected to reach up to 24 million people and its financial impact on the Government’s accounts sums around USD 9 billion.

Moreover, BNDES will allow the withdrawal of resources from programs such as the Profit Participation Program and the Civil Servants’ Investment Program Funds(PIS/PASEP), besides the Guarantee Fund for the Length of Service (FGTS).

¹ The Golden Rule is a Constitutional provision that prevents the Federal Government from getting into debt due to current expenditures, such as salaries and general costs of maintaining the public administration’s structure.

³The Bolsa Família Program, created by Statute #10,836,of 2004, is a direct income transfer program that benefits families insituation of poverty and extreme poverty across the country.

See PDF version here